With the advent of emission regulation policies, such as the Euro standards in Europe, National Ambient Air Quality Standards in the USA and Bharat Stage emission standards in India, there has been a revolution in the production of emission control equipments, specifically catalyst based. Catalysts are used in gasoline or diesel based internal combustion engines. At the onset of the environmental emission regulations, catalysts were only made compulsory for automobiles but with the progress in technology and extent of emissions from production facilities across the world, catalysts were considered necessary for industrial and power plants as well. Emissions occurring from automobiles, heavy duty equipments and industrial plants, besides containing carbon dioxide, also possess certain other compounds, such as carbon monoxide, nitrous oxides and unburnt or partially burnt fuels, which are extremely hazardous for the environment. The regulations have been put in place to curb the emission of such compounds in order to protect the ecology. Catalysts curb the emission of such compounds, convert them to non-hazardous materials and then release them into the atmosphere.

One of the most important drivers for the market is the stringent environmental policies that have been adopted by various governments and environmental protection agencies. These directives guide the market to improve emission control technologies and make them standardized and compliant across the planet. Another driver is the continuous development of new and upgraded catalysts across the market that prompts automobile and industrial catalyst manufacturers to innovate, thus causing replacement of the older catalysts. On the other hand, catalysts face constraints in the form of being expensive to procure or replace. Additionally, since catalytic converters emit carbon dioxide after conversion of hazardous elements, they are faintly responsible for the increased amount of carbon dioxide in the atmosphere. But regardless of the pros and cons of catalysts, market opportunities lie in emerging markets, especially India and China that will affect the market in the near future.

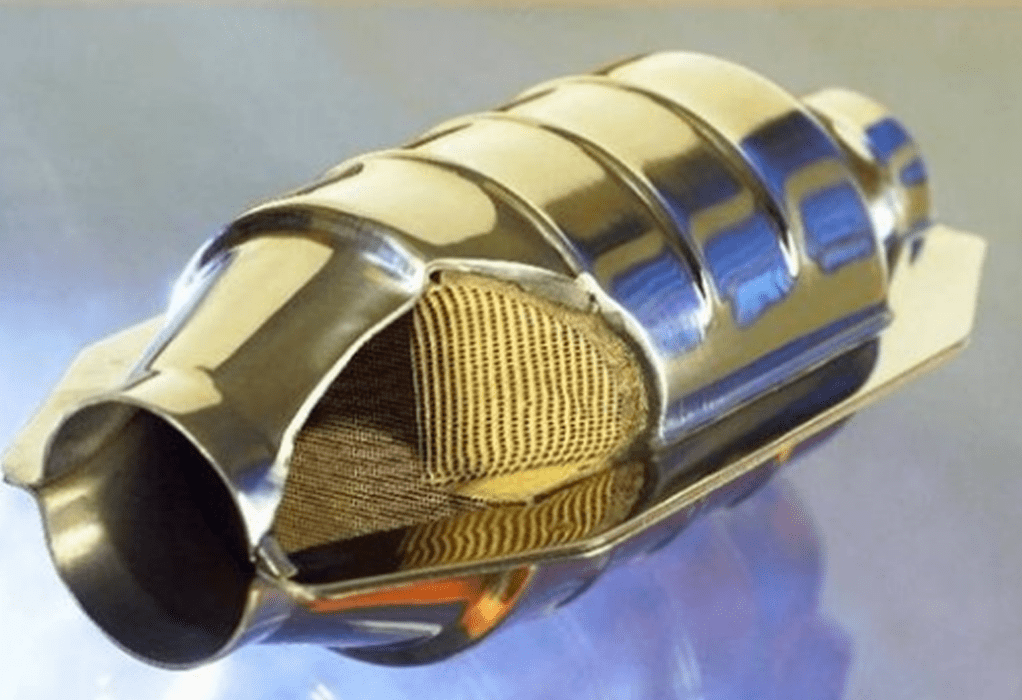

Catalytic converters can be classified based on the application that they are being installed for and type of engine. Based on application, catalysts are industrial or automotive. Under the automotive segment, catalysts can be installed in passenger vehicles, trailers, buses, tractors and earth moving equipment and even aircrafts. For industrial use, the type of catalyst to be installed is decided based on the environmental norms imposed on the particular industry i.e. a petroleum refinery would need the highest grade of catalysts as compared to a food processing unit. Based on the type of engine, catalysts are different for internal combustion engines as compared to spark ignition ones.

Regionally, emission control catalyst market has seen the most growth from North America, due to the highest number of automobiles and industries existing in the region, specifically in the U.S. Due to stringent Euro standards; Europe has also seen increased demand for catalysts, mainly from Germany, Switzerland, Austria, Netherlands, Norway and the United Kingdom. The Asia Pacific expanse is currently seeing a rise in emission control catalyst demand due to the industrialization of emerging economies, essentially from India, China, Malaysia, Vietnam, Pakistan and Japan. Across the rest of the world, heavy demand can be witnessed from U.A.E., Oman, Saudi Arabia, Nigeria, Libya and Brazil.

Some of the companies involved in the manufacturing of control catalysts are: Tenneco Inc., DCL International Inc., KATCON Global, Eastern Manufacturing Inc., Bastuck GmbH &Co., Bosal Nederland B.V. and AirTek Inc.

Recent Posts

Power & Propulsion Technology

Alfa Laval and Wallenius to form joint venture AlfaWall Oceanbird for wind-powered vessel propulsion

Power & Propulsion

Mitsui E&S, TGE Marine Open Dialogue with DG Shipping on Engine and Gas Systems Collaboration

Bunkering Methanol

UK’s first commercial biomethanol bunkering service launched at Port of Immingham